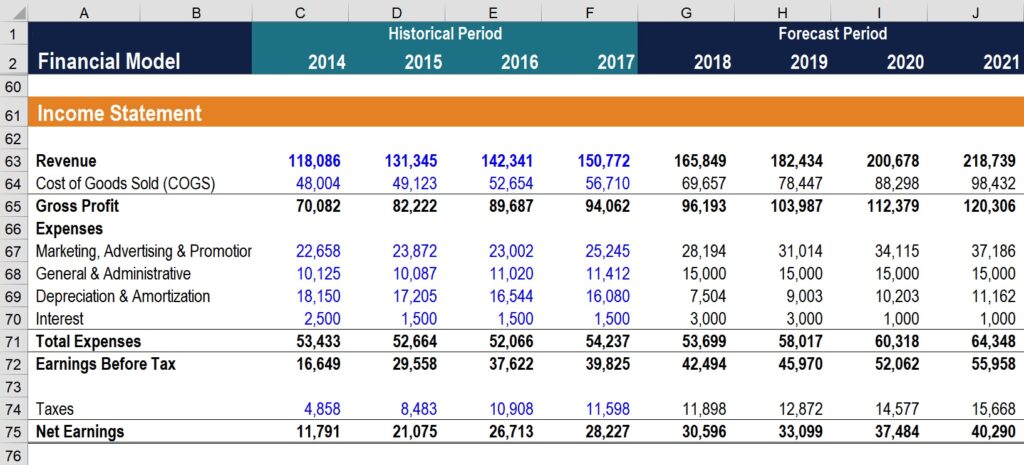

What is the Income Statement?

One of a business’ most important financial statements, the Income Statement details the company’s earnings and expenses for a certain accounting period. A profit or loss is calculated by deducting all operating and non-operating expenditures from total revenues.

In corporate finance (which includes financial modeling) and in accounting, the income statement is one of three statements utilized. The statement organizes the company’s financial data in a comprehensible fashion, detailing its revenue, costs, gross profit, selling and administrative expenditures, other expenses and income, taxes paid, and net profit.

Each section of the statement covers a distinct time frame that corresponds to an essential aspect of the company’s activities. For internal purposes, monthly periods are used most often, however some businesses employ a thirteen-period cycle. We sum the figures reported in these reports every three months to get our yearly report.

Due to its minimal data requirements from the income statement, balance sheet, and cash flow statement, this statement is an excellent starting point for any financial model. This means that the income statement comes first in the chain of financial statements since it contains the most information.

Components of an Income Statement

Due to the fact that a company’s income and expenditures will vary based on the nature of its operations, the income statement may range slightly from one firm to the next. However, most income statements will include a few standard sections.

Here are some of the most typical categories included in an income statement:

Revenue/Sales

Revenue from Sales is the top line of a profit and loss statement and represents money brought in by the business via the sale of goods or provision of services. This sum will include all upfront expenses incurred in bringing a product or service to market. Multiple sources of income are combined to form a company’s top line in some businesses.

Cost of Goods Sold (COGS)

The direct expenses incurred by a business in order to make a profit from selling their products are summed up in a line item called “Cost of Goods Sold” (COGS). If the organization provides a service, this line item may also be referred to as Sales Expenses. Direct costs include things like labor, components, materials, and a portion of things like depreciation that are directly related to the production of the good or service (see an explanation of depreciation below).

Gross Profit

Gross Profit Gross profit is calculated by subtracting Cost of Goods Sold (or Cost of Sales) from Sales Revenue.

Marketing, Advertising, and Promotion Expenses

All businesses have costs that arise from selling their products or services. Because of their similarities and because they all have to do with making a sale, marketing, advertising, and promotion costs are sometimes lumped together.

General and Administrative (G&A) Expenses

All other non-direct costs of doing business go under the heading of “selling, general, and administrative,” or “SG&A.” Expenses like payroll, rent and utilities for an office space, insurance premiums, transportation costs, and even depreciation and amortization are all part of running a business. However, businesses can choose to report depreciation and amortization separately if they so want.